Which of the Following Best Describes Accounts Receivable

Asked Nov 7 2021 in Business by rosacat. Select one or more.

Solved 1 Which Of The Following Best Describes Accounting Chegg Com

Select one or more.

. Insurance Expense would appear on which of the following financial statements. Highly delinquent accounts D. Coolwear wrote off 820 in accounts receivable and determined that there should be an allowance for uncollectible accounts of 1140 at December 31 2016.

NOT Inform the check writer that the check has been returned. Which of the following best describes accounts that. This is an inherent risk at the account level.

Which of the following definitions best describes a write off. Contains only accounts receivable transactions. Used to enable companies to meet special country-specific reporting requirements Incorrect b.

Which of the following best describes accounts receivable turnover ART. The customer will be asked to respond to the confirmation request only if the balance indicated in the request is incorrect. Statement of Owners Equity.

Answer Explanation Answer. Positive accounts receivable confirmations are appropriate. Tanya Company has the following information.

A Accounts Receivable Explanation. Sales to customers using credit cards. Group of answer choices ART is a measure of managements estimate of the ultimate collectability of average accounts receivable.

The adjustment causes an increase in an asset account and an increase in a revenue account. Multiple Choice The amount of cash owed to a company by its customers from the sale of goods or services on account. Both the patient ledger and the accounts receivable ledger.

Which of the following best describes the proper presentation of accounts receivable in the financial statements. Which of the following best describes your concern. Contains accounts that are used by multiple companies to consolidate their financial reporting Incorrect.

AAn accurate estimate of bad debt expense may be arrived at by multiplying historical bad debt rates by the amount of credit sales made during a period. Which of the following best describes accounts receivable turnover ART. They have a projected 930 Accounts Receivable Balance of 80000 with 50000 projected to be collected in October and the rest in November.

The accounts receivable turnover has increased despite a reduction in sales. Which of the following best describes the operative chart of accounts. A The assessment of foreign currency as a control risk factor at the overall financial statement level is incorrect.

Earnings on a per share basis. Changes in Assets Liabilities and Equity over the last accounting period. Which of the following BEST describes a companys Current Ratio.

The amount of cash. Which of the following best describes the concept of the aging method of receivables. This indicates a potential problem with.

Group of answer choices ART is a measure of managements estimate of the ultimate collectability of average accounts receivable. Liabilities are future economic benefits to which a company is entitled. They refer to earnings which have been earned but not yet billed.

A liquidity ratio that estimates how quickly an organization converts receivables to cash. They refer to revenues that are earned in a period but have not been received and are unrecorded. Accounts Receivable minus Accounts Payable.

Which of the following statements best describes a positive request for confirmation of an accounts receivable balance. ART is a measure of how many days are required on the average to collect accounts receivable. Accounts Receivable plus the.

BAccounts receivable should be directly written off when the due date arrives and the customers have not paid the bill. Liabilities are economic obligations to creditors to be paid at some future date by the company c. Current assets divided by current liabilities.

The customer will be asked to indicate to the auditor the balance in hisher account only if it is positive. A profitability ratio that measures how quickly an organization generates revenue B. Accounts Receivable plus the Allowance for Doubtful Accounts in the asset section of the balance sheet.

October and November sales are expected to be on credit with 60 collected the month after the. Accounts Receivable in the asset section of the balance sheet and the Allowance for Doubtful Accounts in the. Cash sales to customers that are new to the company.

What is the first step an office assistant should take after receiving a NSF check. Bad debt expense for 2016 would be. Answer of Which of the following best describes the proper presentation of accounts receivable in the financial statements.

Current assets minus current liabilities. The amount of cash not expected to be collected by a company from its customers from the sale of apods or services on account bad debts. Contains the operational accounts that are used to record the financial impact of an organizations day-to-day transactions.

Up to 25 cash back Which of the following best describes days in accounts receivable A. Which of the following best describes accounts that occasionally go to an outside collection agency. Liabilities are accounts receivable of the company d.

NWC is the difference between a companys current assets and current liabilities such as cash accounts receivableunpaid invoices from customers and raw materials and completed goods inventories. The customer will be asked to indicate to the auditor the current balance in the account. Which of the following best describes a balance sheet.

Accounts w a high accounts receivable ratio B. Use 365 dans and round to one decimal place. Liabilities are a form of share capital b.

Which of the following best describes credit sales. The normal balance of Accounts Payable is. Which of the following best describes accounts receivable.

Which of the following best describes the operative chart of accounts. The tutor can help you get an A on your homework or ace your next test. Accounting questions and answers.

The customer will be asked to inform the auditor whether the balance indicated in the request is correct and to respond regardless of whether such stated balance is correctd. Patients who do not pay in 30 days C. Credit sale is nothing.

The journal entry to record a credit sale is Accounts Receivable. Accounts that have sent bad checks. Which of the following best describes a liability.

Which of the following best describes accounts receivable.

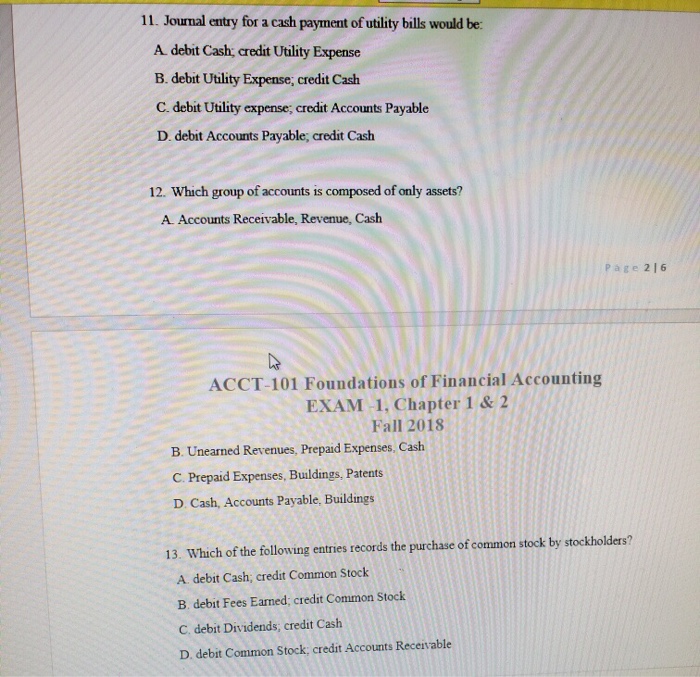

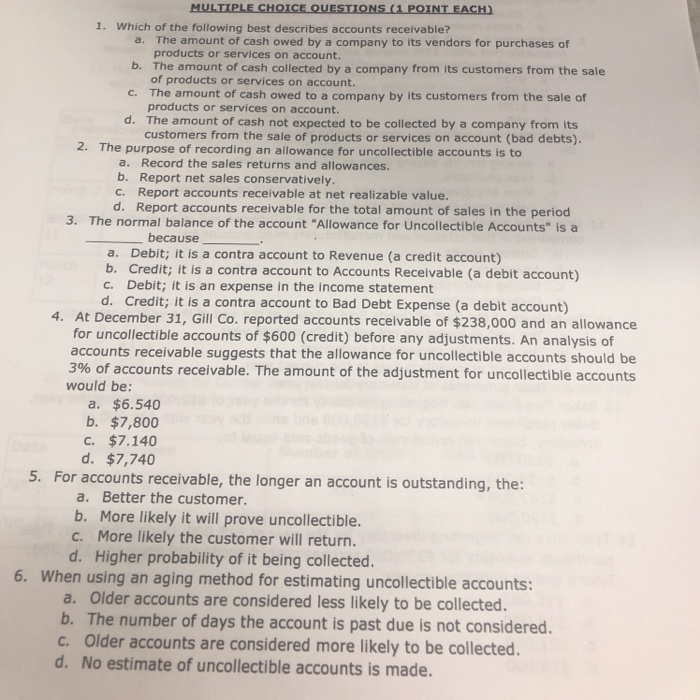

Solved Multiplechoice Ouestionslipointeachi 1 Which Of The Chegg Com

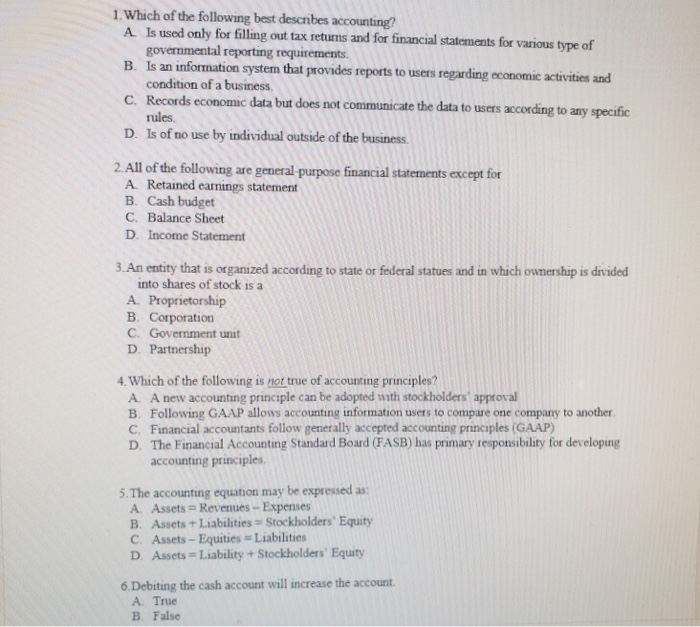

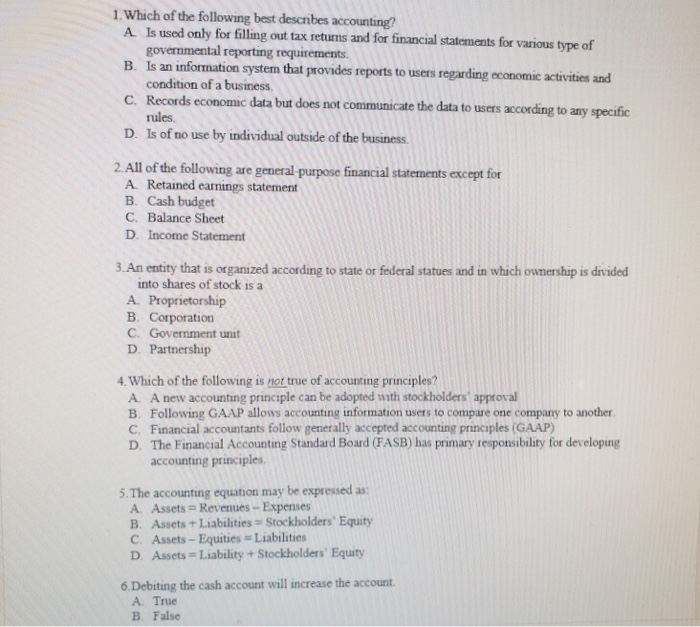

Solved 1 Which Of The Following Best Describes Accounting Chegg Com

Solved Multiple Choices 50 Points 1 Which Of The Chegg Com

Solved Which Of The Following Statements Best Describes An Chegg Com

No comments for "Which of the Following Best Describes Accounts Receivable"

Post a Comment